|

|

« Back |

Post Date: Monday, January 28, 2019 |

|

|

The fourth quarter of this year has given investors a wild ride. After eight straight days of heavy declines, markets bounced hard the day after Christmas, in what was the largest single-day point increase in the history of the Dow Jones Industrial Average. The S&P 500 logged a nearly 5% gain. For context, since 1950, this has only happened 26 times.

In this market environment, there are some natural concerns:

1. The Amount of decline

From its

peak on September 21, the S&P 500 fell 21%. That puts US stocks in bear

market territory (a bear market is loosely defined as a decline of 20% or

more). It has been some time since we have seen such a dramatic decline, and

memories of 2008 still linger in all of our minds--even though stocks are up

more than 250% since that time.

Here is why

I am not worried:

While one

can never be certain, I am confident that we have not entered a recession, nor

is one six months out. With a backdrop of economic growth, we can better

understand the recent bear market. Since 1968, we have seen four bear markets

outside of a recession. The average decline is 23%, with three of those being

20%. The fourth was the flash crash of 1987, which saw a total decline of 34%.

The nature

of this decline makes guessing an exact bottom is impossible, but given history

it seems reasonable to say that we are at least close to a bottom.

Indeed, history gives the impression that we have more upside than downside at

current market levels, which should restore some confidence.

2. The Speed of Decline

Moving 20%

within three months is enough to make anyone's stomach churn. There is no

question that the speed of this decline has been concerning.

Furthermore, such a quick decline causes concern that the next three months may

look similar--it can be very easy to expect the future to look like today.

Here is why

I am not worried:

Quick

downward movement is always scary, but downswings like this almost always

happen quickly. Markets tend to move down more quickly than they move up. So,

while this downswing occurred within the space of three months, that is a 'normal'

move in this type of market. In addition, markets tend to move faster now than

they used to--much of that is likely due to computer trading and added

liquidity. All of that to say, nothing that has happened is too far out of the

ordinary.

3. Lack of Confidence

The

financial media has not helped the average investor feel

confident. Financial media has presented this decline as a disaster with

"more to come." It can be very difficult to remain calm and rational

when authoritative people are yelling "fire" as loudly as they can.

Here is why

I'm not worried:

It is a

well-kept secret that financial news generally doesn't move prices, it is

prices which push the news. When markets are up, the headlines are positive,

and when they are down, the headlines are negative. We have to remember that

newsrooms are in the business of selling news. It is tough to sell news

if your experts are saying "I don't know" all the time, and quite

often, "I don't know" is the right answer.

If you want

to know what headlines will be, look at fundamentals. Ultimately, prices

respond to economic and business fundamentals. And right now, fundamentals are

good: employment is strong, corporate profits are growing, manufacturing is

strong, retail sales are strong, and so on. In fact, most any data point shows

a positive economic picture.

It can be

difficult to stay coldly rational amidst this level of turbulence. Yet for

investors, that is exactly what must be done. Ultimately, this is risk. This is

the price we pay for the return we collect, long term. It should be reassuring

to know that, while unusual, this market environment is not unheard of. Another

reassurance is that bear markets outside of recessions have historically paved

the way for higher prices.

As always, we welcome a conversation. Of course, your risk tolerance and time horizon will always be part of this conversation as those are fundamental factors to your plan. If they have not changed, staying the course--despite the turbulence--is likely the best course of action.

4. Highlights from our Recession Dashboard

Finally,

are some highlights from our latest recession dashboard.

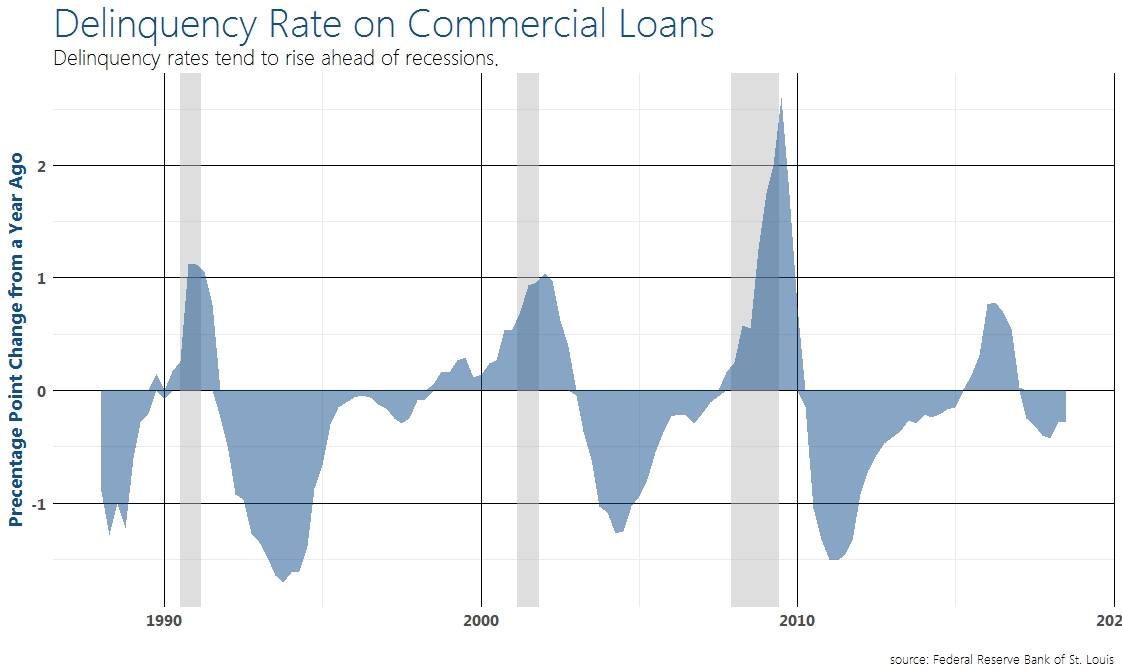

Typically,

before a recession, delinquency rates tend to rise. As you can see in the

chart, delinquency rates have been falling for a little while now.

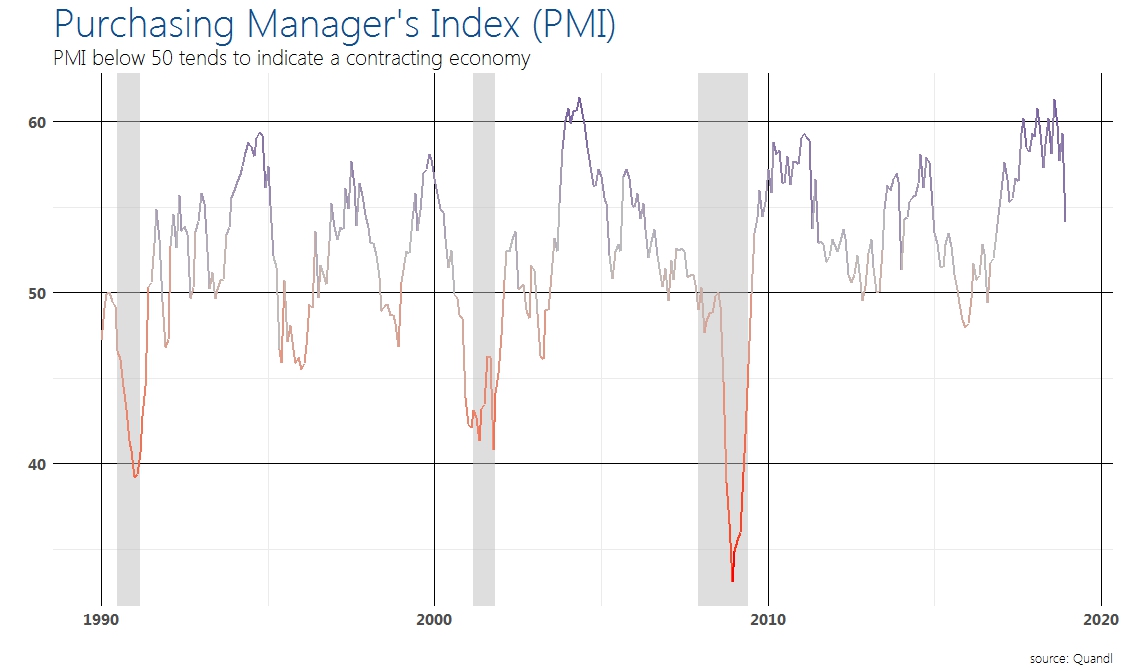

The Purchasing Manager's Index measures manufacturing in the US. Historically, it would be unusual to see a recession with figures as high as they are today.

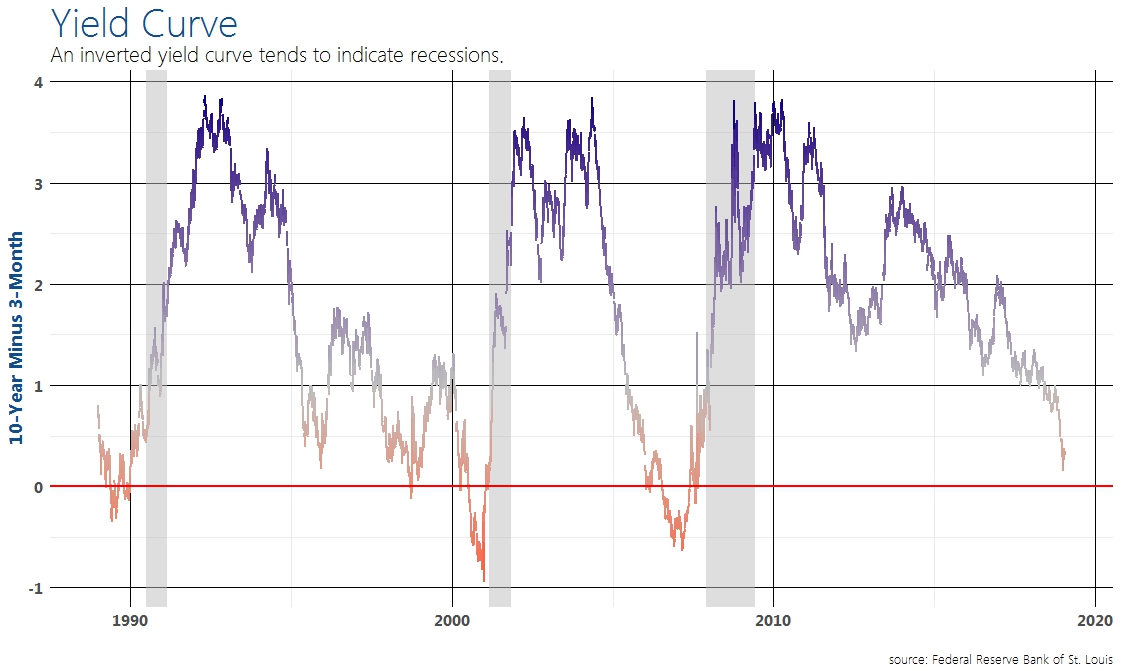

Finally, the yield curve--the 10-year US treasury yield minus the 3-month US treasury yield. Typically, this number turns negative about six months before a recession. While it is signaling late-cycle, it has not signaled a recession is near.

--

All

information provided herein is for informational purposes only and should not

be relied upon to make an investment decision. This presentation is neither an

offer to sell, nor a solicitation of any offer to buy any securities,

investment products, or in-vestment advisory service. The presentation is being

furnished on a confidential basis to the recipient.

The

information herein contains forward looking statements and projections

representing the current assumptions and beliefs based on information available

to Bright Wealth Management, LLC at time of publishing. This information

included is believed to be reasonable, reliable and accurate, (however no

representation is made with respect to the accuracy and completeness of such

data) and is the most recent information available (unless otherwise noted). However,

all the information herein, and such beliefs, statements and assumptions are

subject to change without notice. All statements made involve risk,

uncertainties and are assumptions. Investors may not put undue reliance on any

of these statements. There is no guarantee that the market will move in any

direction, as there is no way to predict with certainty future market behavior.

Due to rapidly changing market conditions and the complexity of investment

decisions, supplemental information and other sources may be required to make

an informed investment decision based on individual objectives and suitability.

|

|

|